Gold reserves play a crucial role in national economies, often offering stability, confidence and a reliable hedge during times of market or economic uncertainty. Gold has long been a symbol of wealth and strength, as it has historically been viewed as a reliable store of value over time, especially during economic upheaval. Central banks and governments worldwide hold significant quantities of precious metals, and the metal of choice tends to be gold. These gold reserves are used to bolster and underpin their financial systems and economies and even to this day, they continue to play a vital role in shaping the global financial landscape.

In this article, we explore the basics and importance of gold reserves, why countries choose to store gold and what the implications are for investors.

What are gold reserves?

In simple terms, gold reserves are quantities of gold which are held by both national central banks and governments across the world. These reserves act as a financial safety net, supporting the value of the national currency and providing a buffer against economic and financial instability.

Although gold reserves play a key role in supporting economies and currencies, it may surprise you to learn that currency is no longer linked to or subject to the gold holdings of a nation. Many people might suggest that if you take a £20 note to the Bank of England, they are obliged to convert it into gold, as the currency is backed by or linked to gold in some way, but this is certainly no longer the case. This confusion may arise from the fact that historically, countries including the UK and the USA used to use a system called ‘The Gold Standard’ which did link the value of the currency to gold. However, Britain left the gold standard nearly 100 years ago in 1931, followed by the US in 1971. Although there are no countries currently using the gold standard, many countries still retain a substantial gold holding, some of which was likely built up during the years the gold standard was in place.

Despite this, gold reserves still play a crucial role in establishing and maintaining the economic stability and health of nations throughout the world. These reserves tend to be held in secure vaults, often within central banks or other official institutions, perhaps most famously, Fort Knox in the US. In theory, these reserves can be called upon in times of economic distress or political turmoil to stabilise the national currency, support government finances and reassure investors. This is because countries with large gold reserves are usually perceived as more financially stable and more resilient to economic shocks.

Why have gold reserves?

Countries maintain gold reserves for several important reasons, cementing them as a vital part of economic planning and strategy. Firstly, as previously suggested, gold reserves provide financial stability as in times of economic uncertainty, gold often acts as a hedge against inflation and even currency devaluation. In addition to this, gold also plays a crucial role in supporting the national currency and instilling confidence in the value of that currency. This is particularly important as, generally speaking, countries issue and rely on ‘fiat’ currency, which is money that is not backed by a physical commodity. By having significant gold holdings, these countries can reassure investors both domestically and internationally that their currency is stable and credible on the international markets.

As with individual investors, one of the other aspects of gold reserves is offering liquidity. In times of need, gold reserves could be quickly and efficiently converted into other assets or currencies which could be invaluable in times of economic emergencies. As an alternative to this, a government may instead choose to borrow large amounts or even print more money, which historically leads to increased inflation.

Lastly, having large holdings of gold can simply make you seem more credible on the international stage. Countries can use their reserves as collateral to secure loans from global financial institutions, or to enhance their geopolitical influence. Countries with large reserves, such as the US, China and Germany are often seen as some of the most economically powerful and stable, offering them more leverage and bargaining power in negotiating economic policies.

Importance of gold in the economy

As an individual or institutional investor, diversification is often cited as one of the key ways in which you can strengthen your portfolio, and the addition of gold is one of the ways in which you may choose to do this. Whilst this is true of individual investors, it is also true on a much larger scale, as gold reserves are particularly important for Central Banks, as they use them to bolster their financial systems. This is because gold is seen as a reliable store of value, simply because it tends to maintain its worth, even in times of political turmoil. This stability is crucial for national economies, as gold helps preserve wealth and purchasing power when other assets may lose value. In addition, these gold reserves act as a safety net for Central Banks and help ensure they meet their obligations during times of financial crisis. By holding significant gold reserves, countries can enhance the credibility of their currencies amongst international trading partners, fostering trust and helping establish stability in the long term.

Again, as with individuals, gold is seen by many as a reliable hedge against inflation, and holding substantial amounts of it can add to this reliability. As the cost of living rises and inflation continues to creep ever higher, the value of gold typically increases. This protects both investors and nations from the eroding effects of inflation and makes gold an attractive asset option for both individual investors and national economies.

What this means for gold investors

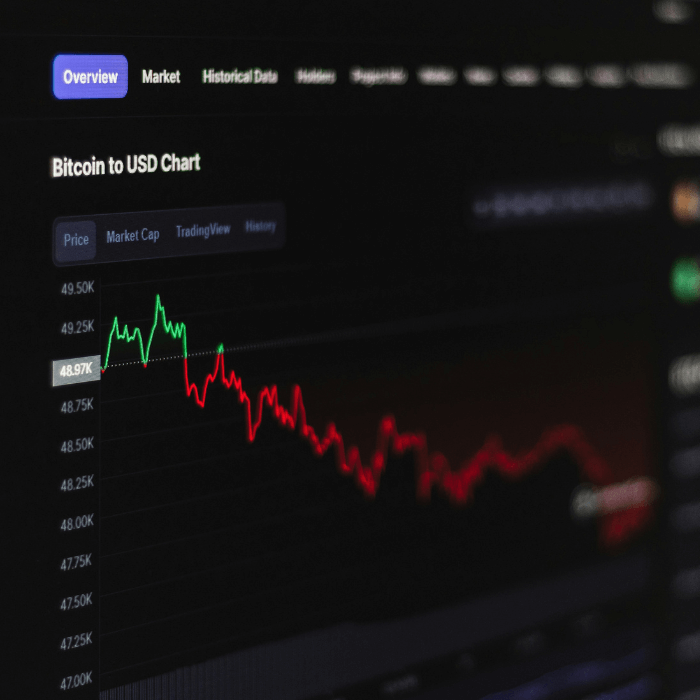

Understanding the role that gold plays in national and international economies can provide valuable insights for gold investors, helping them better understand the role of gold in their investment portfolios. This is ultimately because gold reserves significantly influence global gold prices and also reflect the economic health of countries that you may wish to invest in. These can be crucial indicators for investment strategies as a whole.

As previously mentioned, large gold holdings for any particular country tend to indicate economic stability. Countries with large gold holdings often exhibit stronger economies and more resilient currencies, and when these countries increase their reserves, it can drive up gold prices as a result.

Gold reserves also provide insights into potential buy and sell signals which can aid in your understanding of the wider market. For example, if a country wishes to add to their gold holdings, it may suggest that the country is preparing for economic turbulence. This could in turn suggest that gold prices will be affected and investors may wish to use this information to adjust their portfolios.

In conclusion, understanding the dynamics of gold reserves and their impact on national economies could help investors gain a greater understanding of the wider market and help them make strategic decisions. Keeping an eye on news of large movements in or out of gold by central banks and major gold-holding countries could help investors better understand market movements and optimise their own investment strategies in gold.

Buy and sell gold with The Royal Mint

Investing in gold can be a strategic way to safeguard your wealth and diversify your investment portfolio, and The Royal Mint offers a range of services to help you navigate this with confidence.

For those looking to buy gold, there are a range of products and services available including physical coins, bars and even digital gold. For those looking to sell, The Royal Mint also offers a secure and straightforward way to sell gold, guiding you through each step by providing clarity and peace of mind.

In addition, wealth management services are also available, with a dedicated team on hand to offer guidance on the range of products and services we can offer to help support your goals.

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.