A Millennium in the Making

For over a thousand years, The Royal Mint has been a cornerstone of British heritage, striking coins that have not only facilitated commerce but also encapsulated the history of a nation. From origins in the reign of Alfred the Great to present-day innovations in precious metals investment, The Royal Mint stands as a testament to enduring quality and trust. Through our partnership with HANetf, we reflect on the legacy of The Royal Mint and our evolution into a modern institution that continues to uphold the gold standard.

A Legacy Forged in Silver and Gold

The story of The Royal Mint begins in the ninth century under the rule of Alfred the Great, with the striking of the first silver pennies. These coins laid the groundwork for a tradition of minting that has continued through wars, revolutions and the changing tides of history.

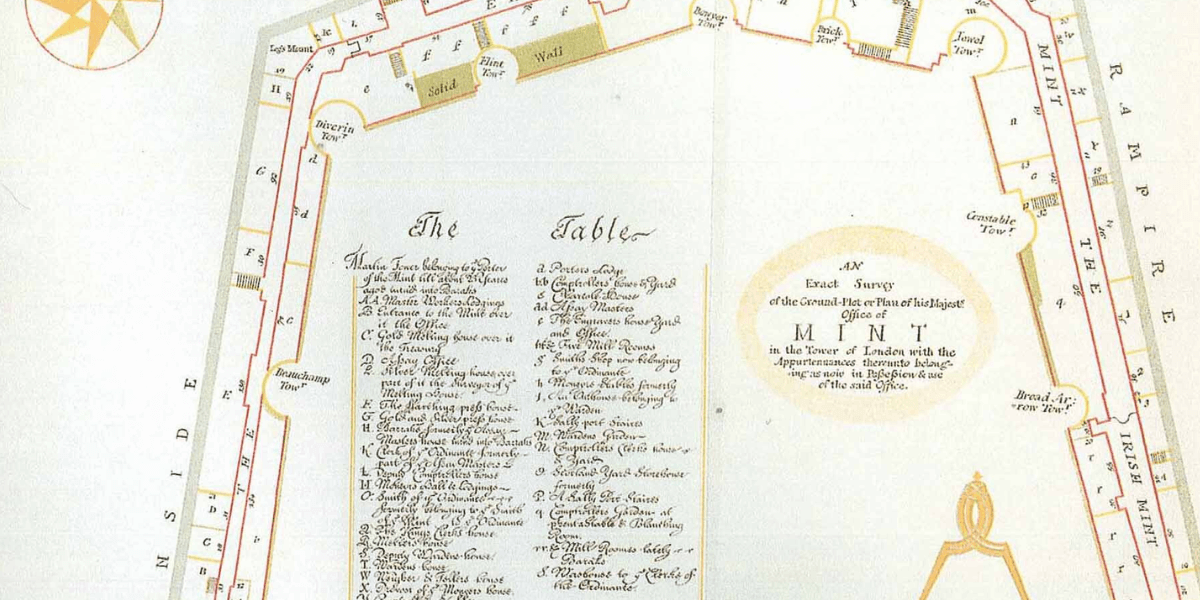

In the thirteenth century, The Royal Mint was centralised in the Tower of London under the reign of Edward I, a move that symbolised the unification and strengthening of the kingdom's economic foundation. We remained within the Tower for over 500 years. During this era, The Sovereign, first struck in 1489 for Henry VII, emerged as a symbol of royal prestige, and has since become known as the ‘chief coin of the world’.

Modern Innovations and The Royal Mint's Evolution

From 1699 until his death in 1727, Isaac Newton, one of history's most revered scientists, served as Master of the Mint. His tenure was marked by his relentless pursuit of reform, which included implementing rigorous anti-counterfeiting measures and establishing a gold standard that would endure for centuries. Newton's influence solidified The Royal Mint's reputation as a trusted institution, ensuring that British currency remained a model of precision and reliability.

The nineteenth and twentieth centuries brought significant changes to The Royal Mint. As Britain's influence expanded, so too did the demand for coinage. In 1812, The Royal Mint relocated from the Tower of London to Little Tower Hill to modernise coin-making, with working areas for larger, more developed machinery.

In 1968, we moved to our current location in Llantrisant, South Wales. This state-of-the-art facility was opened in anticipation of decimalisation, marking a new era in British currency as the nation transitioned to a decimal system in 1971.

The Llantrisant facility, one of the most advanced minting facilities in the world, allowed us to scale operations to meet the demands of a globalising economy. We also became a hub for innovation, where modern minting techniques were developed, and began diversifying our offerings beyond circulating coins.

In 1987, we introduced the Britannia bullion coin, further cementing our position in the global bullion market. Britannia, with its iconic design by Philip Nathan, quickly became one of the world's most recognised and trusted bullion coins. Other bullion products followed, including minted bars and digital investment options like DigiGold, which allow investors to accumulate precious metals in fractional quantities.

The Unbroken History of Gold

Gold has always been central to The Royal Mint's operations. For over 1,100 years, gold has been synonymous with wealth, security and stability – a medium that has stood the test of time. Our bullion products, including the Britannia and Sovereign coins, are not only symbols of this legacy but also tangible assets that offer security and stability in uncertain times.

The launch of The Royal Mint Responsibly Sourced Physical Gold ETC (RMAU), our physically backed gold exchange-traded commodity (ETC), represents a significant step in making gold investment accessible to a broader audience. Developed in partnership with HANetf, RMAU combines the flexibility of stock market trading with the security of physical gold ownership.

A Future-Focused Mint

Whilst The Royal Mint is deeply rooted in history, we also look towards the future with a renewed focus on sustainability and innovation. As part of our commitment to responsible sourcing and environmental stewardship, we have partnered with Canadian cleantech start-up Excir to recover precious metals from electronic waste. This pioneering technology enables us to reclaim gold, silver and other metals from discarded electronics, addressing a growing environmental challenge whilst creating a sustainable source of precious metals.

In addition, we launched 886 by The Royal Mint, a luxury line of jewellery crafted from reclaimed precious metals. This initiative preserves natural resources and reflects our commitment to sustainability as much as our dedication to tradition.

RMAU: The Pinnacle of Gold Investment

The RMAU ETC is the culmination of centuries of expertise in handling precious metals. It offers a unique opportunity for investors to gain exposure to physical gold through a flexible and secure product. RMAU is fully allocated, meaning each ETC share is entirely backed by London Bullion Market Association (LBMA) Good Delivery bars, where the 400oz bars are custodied at The Royal Mint’s purpose-built vault – one of Europe’s most secure sites. This provides the greatest level of security and transparency to those considering or already invested in RMAU.

Moreover, RMAU's inclusion in various investment vehicles, such as self-invested personal pensions (SIPPs) and individual savings accounts (ISAs), makes it a potentially attractive option for investors diversifying their portfolios with a tangible asset that has historically performed well in times of economic uncertainty. Our commitment to sustainability further enhances the appeal of RMAU, as investors can be assured that their gold is sourced and managed responsibly.

…

As our practices continue to evolve, we remain steadfast in our mission to uphold the highest standards of quality, trust and innovation. From our beginnings under Alfred the Great to our current status as a leader in precious metals investment, we have demonstrated a remarkable ability to adapt and thrive. The launch of the RMAU ETC in partnership with HANetf is one of the latest chapters in our storied history, offering investors a secure and sustainable way to invest in gold – a commodity that has been a store of value for over a millennium.

By looking to the future whilst honouring our past, we will continue to be a symbol of excellence for future generations. Whether through iconic bullion products, innovative investment options or sustainable practices, The Royal Mint is making history.

Risks

When investing in ETCs your capital is fully at risk and investors may not get back the amount originally invested. Investors should obtain independent advice before making a decision. Any decision to invest should be based on the information contained in the relevant prospectus. ETC securities are structured as debt securities and not as shares (equity).

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.

Sources

INV498274 New Premium TRM Welcome Brochure_P2.pdf