Join a Global Community of

Gold Bullion Investors

+58k

Precious Metal Investors

Global

Investment Community

+£345M

Gold Under Management

Why Gold?

Proven Track Record

Gold has increased in value by an average of 10% per year over the last 20 years, making it an attractive long-term investment.

An International Commodity

Gold has a global spot price – an agreed current worldwide value – which means it is readily available and easy to buy and sell at any time.

Spread Your Risk

As gold holds its value, many consider it a ‘safe haven’ asset. Usually performing well when riskier stocks fall, it helps to create a diverse and more stable investment portfolio.

Why Bullion?

Tax Advantages

Gold bullion coins and bars are exempt from Value Added Tax (VAT) and gold bullion coins are also exempt from Capital Gains Tax (CGT) for UK residents.

Mitigates Systemic Risk

Holding physical gold rather than exposure through financial instruments adds a layer of security, as the gold is vaulted outside of the general banking system.

Unique Designs

Gold bullion is available to purchase in a variety of eye-catching designs and weights from one gramme to four hundred ounces.

Why The Royal Mint?

Home of Precious Metals

Owned by His Majesty’s Treasury, The Royal Mint has a rich history with precious metals spanning more than 1,100 years.

Transparent Pricing

No commitments, simple management fees and the ability to sell back your investment at any time.

Secure Storage

Safely store your gold bullion investments in The Royal Mint’s highly secure, on-site vault.

Our Most Popular Bullion Products

Discover The Royal Mint’s most popular gold bullion coins and bars, which

have been crafted

from the finest gold for discerning investors.

most popular

Britannia

From

VAT Exempt

CGT Exempt

Struck in 24 carat fine gold

Gold coins and bars available in various sizes

All Britannia gold coins are CGT and VAT exempt for UK residents

Best-Value Bullion Coins

From

VAT Exempt

CGT Exempt

Lowest Premium

Cost effective pre-owned gold bullion coins

Available in 22 and 24 carat fine gold

All gold bullion coins are exempt from CGT and VAT for UK residents

The Sovereign

From

VAT Exempt

CGT Exempt

Known as the ‘chief coin of the world’

Struck in 22 carat fine gold and available in a variety of sizes

CGT and VAT exempt for UK residents

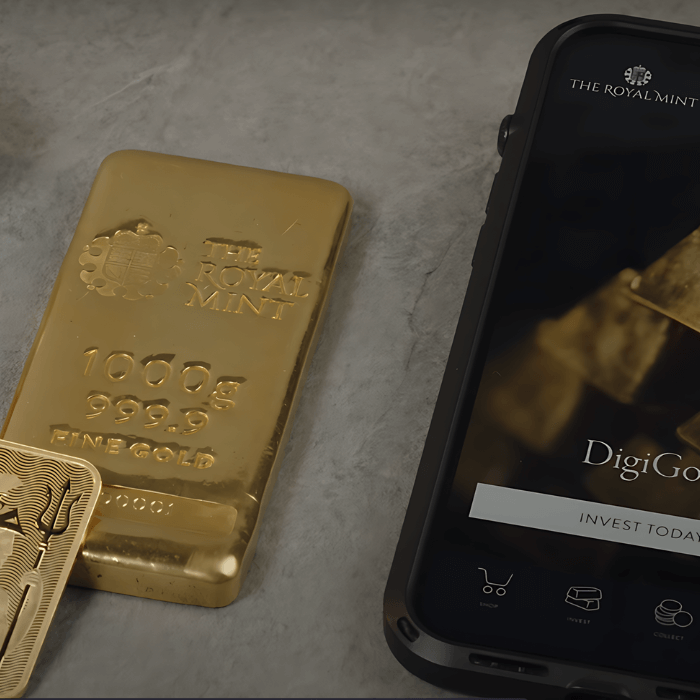

Cast Bars

From

VAT Exempt

1kg and 500g 999.9 fine gold bars

Free insured UK delivery

All bars are exempt from VAT for UK residents

Our Most Popular Bullion Products

Discover The Royal Mint’s most popular gold bullion coins and bars, which have been crafted from the finest gold for discerning investors.

most popular

VAT Exempt

CGT Exempt

Struck in 24 carat fine gold

Gold coins and bars available in various sizes

All Britannia gold coins are CGT and VAT exempt for UK residents

VAT Exempt

CGT Exempt

Lowest Premium

Cost effective pre-owned gold bullion coins

Available in 22 and 24 carat fine gold

All gold bullion coins are exempt from CGT and VAT for UK residents

VAT Exempt

CGT Exempt

Known as the ‘chief coin of the world’

Struck in 22 carat fine gold and available in a variety of sizes

CGT and VAT exempt for UK residents

VAT Exempt

1kg and 500g 999.9 fine gold bars

Free insured UK delivery

All bars are exempt from VAT for UK residents

Book an appointment

Manage Your Wealth With The Royal Mint

Discover our account management service, as well as our pension accounts and ETC product.

Frequently Asked Questions

Throughout most of human history, people have treasured, prized and collected gold objects and gold coins. The value lies in the precious metal itself and does not rely on external markets to determine its performance.

An investment can be seen as a risk at any time. When investing in gold it is important to pay attention to factors such as interest rates and world events, as these are the most common ways that the price of gold is affected.

Investors can choose to invest in physical gold in the form of coins or bars, or they can invest in gold digitally, buying virtual fractions of a real gold bar.

Modal title

Modal body text goes here.