Britannia 2020 1 oz Silver Bullion Twenty Five Coin Tube

Bullion | 999 Fine Silver

Choose your option

As the Roman Empire expanded, conquered provinces were personified with female figures; a means to establish order and create a sense of unity. Extending its influence northwards, the Roman army eventually crossed the channel to reach British shores. Britannia first appeared on the coins of the Emperor Hadrian over 2,000 years ago.

Restored to British coinage in 1672 during the reign of Charles II, she’s appeared on the coins of every subsequent monarch. Reassuring and resolute she’s a rallying point come crisis or celebration, an embodiment of our national pride. Instantly recognisable all over the world, Britannia resonates with international investors, a trusted symbol of the quality of British minting.

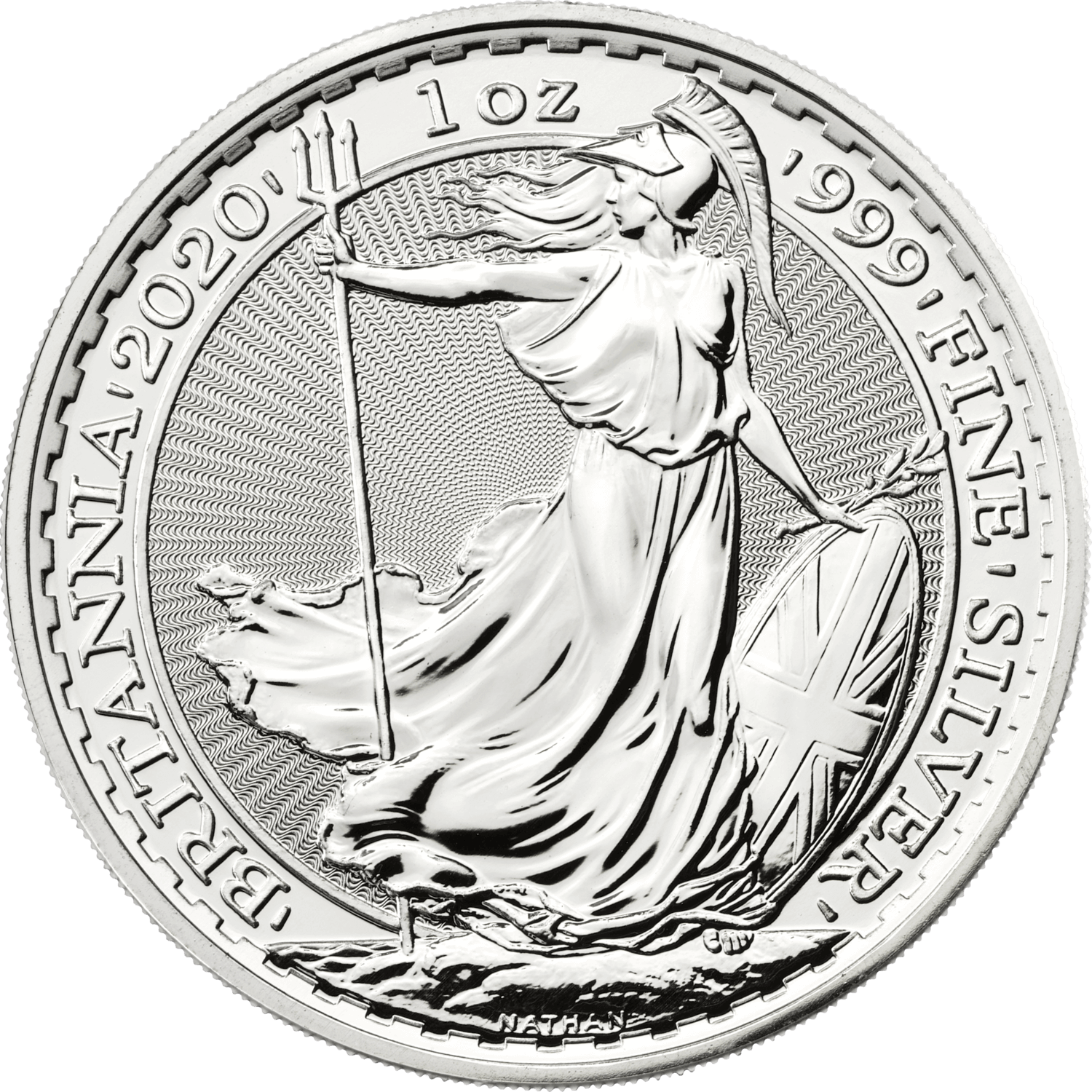

The Royal Mint is proud to present the 2020 Britannia coin featuring Philip Nathan’s classic design. Standing firm in the eye of the storm, she displays an unyielding resolve. Since it was chosen to adorn the very first Britannia bullion coin in 1987, it has been acclaimed as a modern masterpiece.

Key Points:

- Struck to bullion standard

- Each coin contains 1 troy oz of 999 fine silver

- Exempt from capital gains tax for UK residents

- Packaged in a coin tube

* Bullion product prices displayed include the precious metal price and any applicable premium. Any promotions or discounts are applied to the premium above the precious metal price only and not on the metal price itself.

How are bullion prices calculated?

The 'buy' and 'sell' prices shown on the website represent the market value of raw vaulted metal in an 'unallocated' form. This is the standard way prices are quoted throughout the bullion industry. In order for The Royal Mint to deliver beautifully crafted precious metals products to your address, or to our vault, a number of processes must take place, all of which incur a cost. These processes include transportation, refining, minting, quality checking and merchandising.

The price at which The Royal Mint is able to sell bullion products to consumers is therefore made up of the 'spot price' (the buy price) plus an additional premium. The premium accounts for the costs incurred in manufacturing a particular product and is usually either a percentage of the buy price or a fixed monetary amount. In short, manufactured bullion products always sell at a premium to enable retailers and manufacturers to cover their costs.

Can I spend/pay using my bullion coins?

All UK coins, whether circulating or non-circulating, are authorised as “legal tender” by Royal Proclamation, in accordance with the Coinage Act of 1971.

Legal tender allows UK coins to be accepted for payment of debts in court – but, only circulating legal tender coins are designed to be spent and traded at businesses and banks. The Royal Mint creates commemorative and bullion coin series to celebrate key moments or individuals, and these are treasured for their collectable and aesthetic value, or purchased for investment opportunities. However, these non-circulating, commemorative and bullion coins are limited edition and will not enter general circulation – meaning banks and businesses are not required to accept them.

For more information on legal tender guidelines see: www.royalmint.com/aboutus/policies-and-guidelines/legal-tender-guidelines

Specification

Britannia 2020 1 oz Silver Bullion Twenty Five Coin Tube

| Specification | Value |

|---|---|

| Denomination | £2 |

| Alloy | 999 Fine Silver |

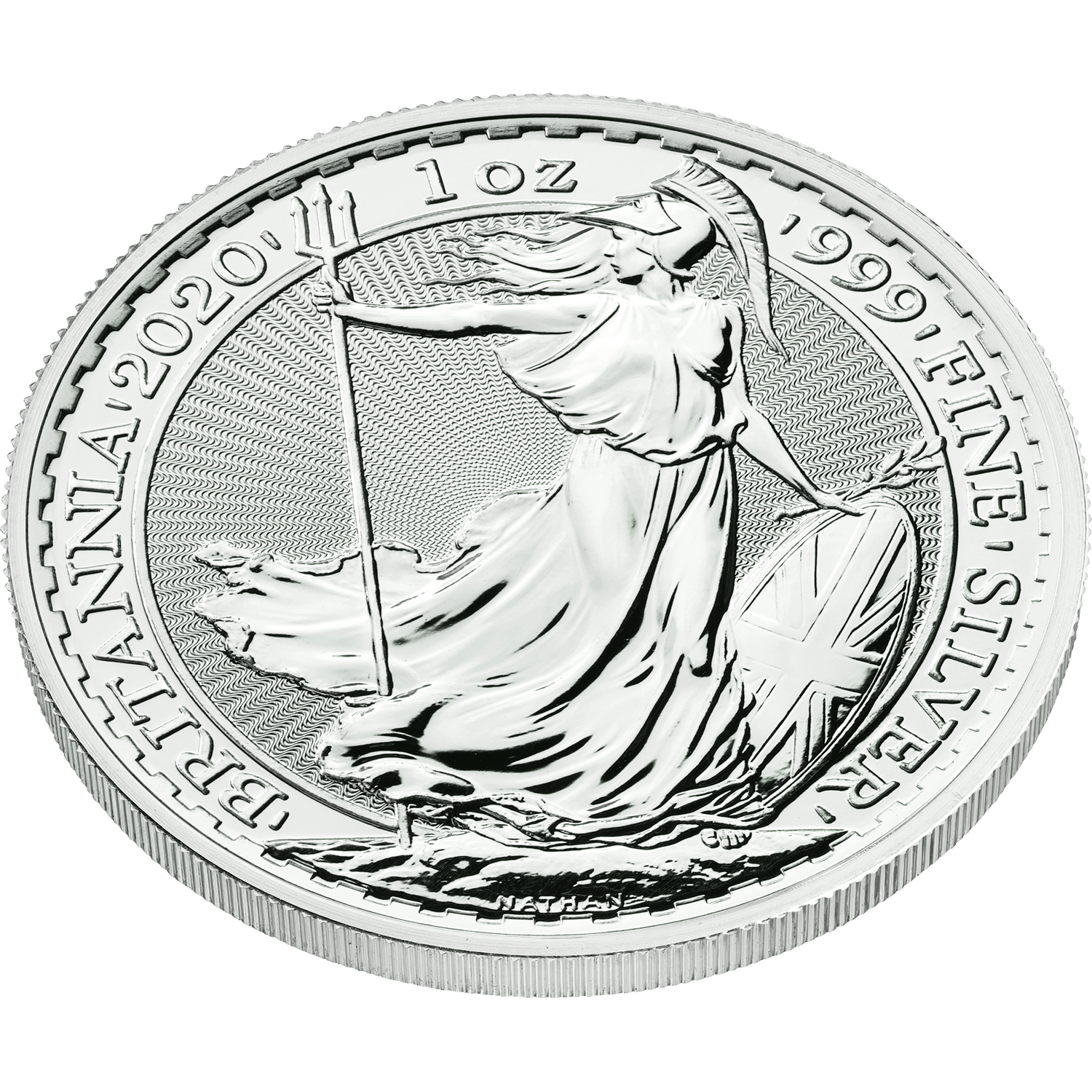

| Diameter | 38.61mm |

| Reverse Designer | Philip Nathan |

| Obverse Designer | Jody Clark |

| Specification | Value |

|---|---|

| Quality | Bullion |

| Year | 2020 |

| Pure Metal Type | Silver |

| Pure Metal Content | 1 Troy Oz |

| Fineness | 999 |

| Packaging | Coin tube |