Gold Extends Drop to Trade Near Two-Month Low on US Dollar Rally

Bloomberg

November 2024

Category: Invest

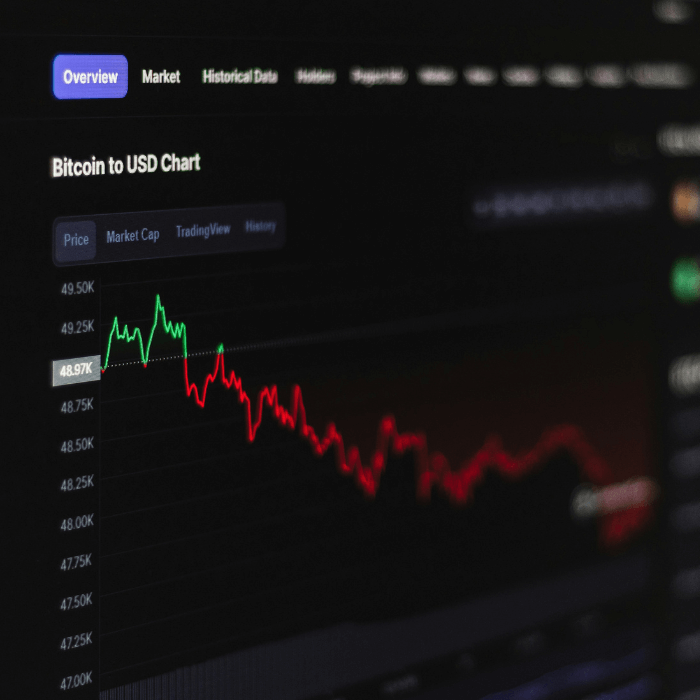

(Bloomberg) -- Gold slipped for a fifth day as a surge in the dollar weighed on the metal, even as US inflation data supported the case for another Federal Reserve rate cut next month.

Bullion dropped 0.7% in early London trading. A gauge of the dollar is at a two-year high on expectations that President-elect Donald Trump’s win will boost economic growth and corporate profits. A stronger greenback makes commodities priced in the currency more expensive for most buyers.

Wednesday’s US consumer price data fell, in line with expectations on a headline basis, although the annualized three-month core rate picked up. Overall, the numbers were supportive of a potential Fed cut in mid-December, with swaps traders pricing in the likelihood of that to more than 80%. Lower borrowing costs tend to benefit gold, which doesn’t pay interest.

The precious metal has dropped more than 8% from a record high on Oct. 31, with losses accelerating after Trump’s White House victory. Prices are still up by about 25% this year, supported by the Fed’s monetary easing cycle, central bank purchases and heightened geopolitical and economic risks that’s driven haven demand.

Spot gold was down 0.7% at $2,555.96 an ounce as of 8:28 a.m. in London. The Bloomberg Dollar Spot Index was steady, after hitting the highest level since 2022 on Wednesday. Silver, platinum and palladium all fell.

©2024 Bloomberg L.P.

Original article here - Gold Extends Drop to Trade Near Two-Month Low on US Dollar Rally – BNN Bloomberg

CGT Exempt Bullion Coins

With the recently drop in Gold, Silver and Platinum prices, now is a great time to discover our CGT-free bullion investments- including The Sovereign, Britannia and our other popular bullion coin ranges.

Buy UK Gold, Silver & Platinum Coins & Bars | The Royal Mint

Notes

The content of this article is accurate at the time of publishing, is for general information purposes only, and does not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.