Gold and treasury bonds are both considered by some to be safe-haven investments, often used to protect wealth during times of economic uncertainty. While gold is a physical asset prized for its historical value, treasury bonds are issued by governments and offer fixed interest and guaranteed returns if held to maturity. Each asset type comes with its own characteristics regarding liquidity, risk, and possible returns. This article reviews the key differences between gold and treasury bonds, helping you better understand how each could play a role in a diversified investment portfolio.

Disclaimer: The information in this article is for educational purposes only and does not constitute financial advice. Please consult with a financial adviser before making any investment decisions.

What is a Treasury Bond?

A treasury bond, often referred to as a gilt in the UK, is a government-issued debt security that offers investors fixed interest payments over a set period. In exchange for lending money to the government, investors receive periodic interest and the return of their principal when the bond reaches maturity. Treasury bonds are typically considered low-risk investments due to the backing of the government, and they are available with different maturity time-scales, often ranging from 10 to 30 years.

How to Buy and Sell Treasury Bonds

Treasury bonds can be purchased through several channels, including banks, investment platforms, and directly from the UK government. Investors can buy gilts either when they are first issued or on the secondary market, where previously issued bonds are traded. Selling treasury bonds before maturity is also possible through the secondary market, though the price will depend on prevailing interest rates. While bonds held to maturity offer guaranteed returns, those sold early may be subject to market fluctuations, which can affect their final sale price.

Comparing Treasury Bonds with Gold as an Investment

When comparing treasury bonds with gold as investment options, several key factors come into play: price, liquidity, risk, and yield or returns. These elements are crucial for investors because they affect both the potential returns and the flexibility of each investment. Understanding how these assets differ in these areas can help guide your personal investment decisions and strategies.

Price of Asset

The price of an asset is a critical consideration for any investor, as it directly impacts both affordability and potential returns. Whether you are investing in gold or treasury bonds, the initial cost of the asset will influence the size of your investment and the overall growth potential. Affordability, combined with potential future price changes, plays a key role in shaping a tailored and effective investment strategy.

Price of Gold

The price of gold is determined by global market conditions and can fluctuate based on factors such as supply, demand, inflation, and geopolitical events. Gold is traded internationally, and its value is typically measured per troy ounce. Investors have the flexibility to choose from various gold products, including coins and bars, which can accommodate different budget levels. For example, smaller coins may be more affordable and liquid, while larger bars may offer better value per ounce for long-term investors. The Royal Mint offers a range of gold investment options, including the Sovereign and Britannia coins as well as bars in a variety of sizes and metals which allow for investment at multiple price points.

Treasury Bond Price

UK treasury bonds, known as gilts, have a minimum investment of £100, and additional investments can be made in £100 increments. Treasury bonds are issued with fixed maturity terms, commonly 10, 20, or 30 years. The price of a gilt is determined by the bond’s interest rate and market conditions, but the principal and interest are guaranteed if held until maturity. This structured approach to pricing offers investors clarity on their long-term investment, making gilts a more predictable choice than some other options. Unlike gold, the price of gilts remains largely stable unless sold on the secondary market, where prices can vary based on interest rates.

Asset Liquidity

Liquidity refers to how easily an asset can be converted into cash without significantly affecting its market value. When choosing between investments like gold and treasury bonds, liquidity is an important factor, as it determines how quickly and easily you can access your funds if needed.

Liquidity of Gold

Gold is considered a highly liquid asset, as it can typically be sold easily across the world. Physical gold, such as coins and bars, can be sold through dealers, online platforms, or directly to other investors. Digital gold, like The Royal Mint’s DigiGold, offers even greater liquidity, allowing investors to buy and sell fractional amounts with ease. The digital format enables quicker transactions and eliminates the need for physical handling, making it easier to respond to market changes. This flexibility makes gold, particularly digital gold, an appealing option for investors who value liquidity and the ability to access funds quickly.

Treasury Bonds Liquidity

Treasury bonds, including UK gilts, can be traded on the secondary market, giving investors the option to sell before the bond reaches maturity. However, the liquidity of treasury bonds can be influenced by prevailing interest rates. When interest rates rise, the market value of existing bonds may decrease, making it harder to sell them at face value.

Investment Risk

Gold and treasury bonds are both viewed as safe-haven investments, offering protection during periods of economic instability. However, they come with different risk profiles. While treasury bonds are generally considered low-risk due to government backing, gold is subject to market price fluctuations.

Risk of Gold Investment

While gold is often considered a stable long-term investment, it is not without short-term risks. The price of gold can fluctuate based on global economic factors, such as inflation, interest rates, and geopolitical events. Although gold has historically maintained its value over time, these short-term market movements can lead to price volatility. Investors should be mindful that while gold can offer stability during periods of uncertainty, its price can still rise or fall unexpectedly, particularly in the short term. This is why it is important to consider these fluctuations when incorporating gold, or any investment, into a diversified portfolio.

Risk of Treasury Bonds

Treasury bonds are generally viewed as low-risk investments due to their government backing. Investors who hold bonds to maturity are guaranteed the return of their initial investment plus interest. However, one potential risk lies in interest rate changes during the bond's term. If interest rates rise, the value of existing bonds may decrease if sold on the secondary market before maturity. Additionally, there is the risk of locking in lower interest rates in times of economic stability, which may offer lower returns compared to other investments during that period.

Asset Yields

Yields refer to the returns an investor can expect from an asset, typically calculated as a percentage of the investment’s cost. In the context of precious metals like gold, yields are derived from changes in market prices, while treasury bonds offer fixed yields in the form of interest payments. Understanding how yields differ between these assets is essential when considering the overall return on investment.

Gold Investment Yields

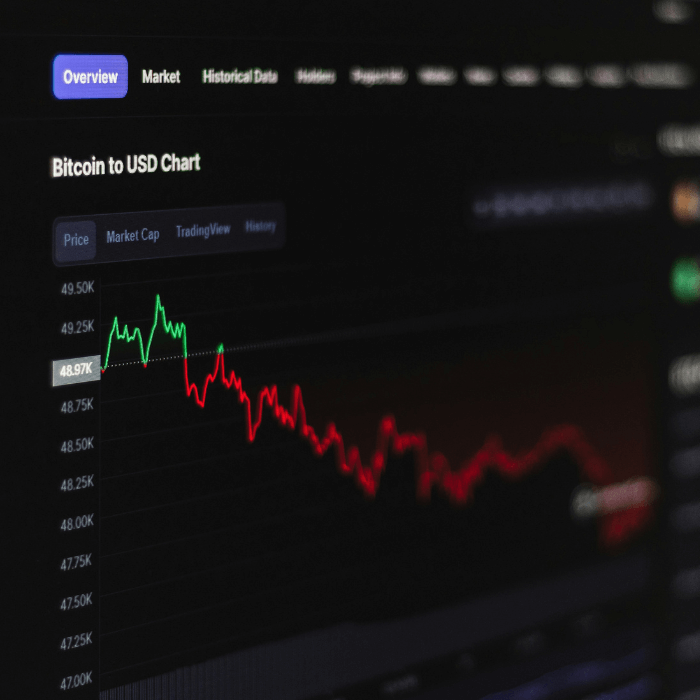

Gold’s price movements over the years have demonstrated both potential gains and losses. While gold is often seen as a stable long-term asset, its annual price fluctuations can vary significantly based on global economic factors. For example, in the past five years, the price of gold has risen during times of economic uncertainty but has also seen periods of decline when market conditions stabilised.

Treasury Bond Yields

Yields for treasury bonds are set when the bond is purchased and represent the fixed interest payments investors receive. If the bond is held until maturity, the returns are guaranteed, perhaps making these bonds a comparatively low-risk investment. However, selling a bond before maturity often comes with a penalty of forfeiting three months’ interest, which reduces the overall yield. Additionally, changing interest rates can impact the value of a bond if sold on the secondary market. Higher interest rates may make earlier bonds less attractive, potentially affecting their resale value.

Gold or Treasury Bonds

Both gold and treasury bonds are considered by many to be safe-haven investments with different strengths. Gold offers long-term stability but with short-term price fluctuations, while treasury bonds provide fixed returns if held to maturity. For those interested in diversifying with gold, explore The Royal Mint’s range of investment options, including physical gold and digital assets.

Notes

Both gold and treasury bonds are considered by many to be safe-haven investments with different strengths. Gold offers long-term stability but with short-term price fluctuations, while treasury bonds provide fixed returns if held to maturity. For those interested in diversifying with gold, explore The Royal Mint’s range of investment options, including physical gold and digital assets.

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.