There have been sharp declines in the cryptocurrency market in recent days, as the value of Bitcoin and other cryptocurrencies has plummeted. Though experts do not believe market activity to be indicative of a longer-term trend, some investors may be looking to explore alternative investment options, and, in times of market uncertainty, gold is often viewed as a stable asset offering certain qualities that other cryptocurrencies may lack.

Recent Cryptocurrency Market Issues

In the past few days, the cryptocurrency currency market has seen a dramatic downturn with Bitcoin, the leading cryptocurrency experiencing a 20% drop in 24 hours and reaching its lowest level in 6 months. Although this recent decrease is notable, this decline is part of a broader trend affecting the wider crypto market which has lost billions in value in recent months. Although much of the news is focused on Bitcoin, Ethereum and other tokens have also faced similar challenges, influenced by several economic factors.

Weak job reports and rising unemployment rates in the USA have fuelled concerns of an economic slowdown. Additionally, there have been adjustments to the interest rates in some markets including the Bank of England and the Bank of Japan. These developments, and many others, may have influenced investors to sell assets which are seen as risky, which may in turn influence the decline seen in the cryptocurrency market.

The Volatility of Cryptocurrencies

Cryptocurrencies are well known for their high volatility and market sensitivity, something which may be seen by some investors as an attractive proposition as values can both increase, and decrease, in a short space of time. The recent crash underscores how quickly these values can fluctuate, often reacting sharply to economic indicators and investor sentiment and as such, this volatility makes cryptocurrencies a high-risk investment which is susceptible to significant swings over a short period.

This volatility is a double-edged sword as whilst it may allow for gains during bullish periods, it also poses risks during downturns in the market. Analysts have noted that the rapid growth of the crypto market and subsequent corrections are typical of its highly speculative nature.

The Stability and Value of Gold

In contrast to the volatility of cryptocurrencies, gold has long been seen as an asset which provides a level of long-term stability, particularly during periods of economic uncertainty. This is because historically, gold tends to retain its value over time and even appreciate when other markets are in turmoil. This stability could provide a sense of security for investors who are looking to protect their wealth against market fluctuations, if gold forms part of their diversified investment portfolio. This is because unlike cryptocurrencies, which have been seen to experience dramatic price swings, gold's value is influenced by a broader range of factors including global economic conditions and geopolitical events.

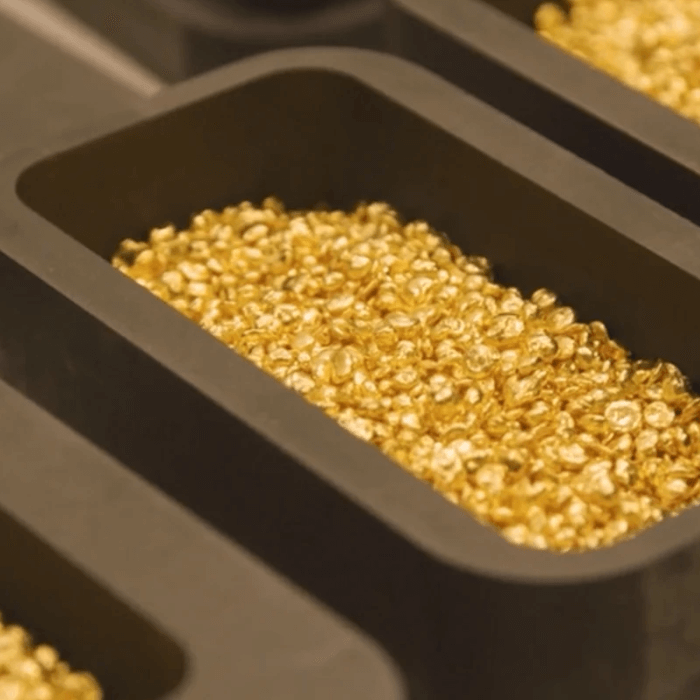

Another possible benefit of gold which is often noted is the liquidity of the asset. Gold is one of the most internationally and historically recognised assets available and can easily be bought and sold around the world. This universal acceptance means that investors can convert physical gold into cash relatively quickly. Part of the reason behind this is the tangible nature of gold. As a physical asset, it may be seen to offer a sense of security that digital tokens may simply not provide by their very nature.

In addition, institutional trust in gold could be seen to further reinforce its value because Central Banks around the world, as well as large financial institutions, often hold substantial reserves of gold as part of their investment portfolios. This institutional trust is a testament to the enduring value of gold, coupled with its reliability as a store of wealth.

The Royal Mint, with its longstanding history and reputation, plays a significant role in the gold market. As a trusted institution, The Royal Mint offers a range of gold investment solutions including physical coins and bars, as well as digital gold.

In Conclusion

As the cryptocurrency market experiences another round of volatility, investors may be seeking out alternative investment options. Gold has historically provided a level of long-term stability and institutional trust, often during times of market and economic uncertainty.

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.