Diversification is considered one of the most important investment strategies for managing risk and potentially maximising returns. By spreading investments across different asset types, you may reduce the impact that market fluctuations have on your portfolio. This principle applies not only to stocks and shares but also to precious metals like gold, silver, and platinum.

What is Diversification?

Diversification is a common concept in investing that involves spreading investments across different asset types to reduce risk. Instead of placing all capital into one investment, diversification helps spread risk so that, in theory, poor performance in one area shouldn’t heavily impact your overall portfolio.

In terms of precious metals, diversification could mean investing in different forms of bullion (such as bars and coins) and a variety of metals like gold, silver, and platinum. By diversifying within your precious metal investments, you may be able to reduce exposure to price swings in one particular metal and take advantage of varying market trends, which could help contribute to a more stable, long-term investment approach. Overall, diversification aims to help make your precious metals portfolio more resilient to fluctuations in global market conditions.

Diversified Investment Strategies for Precious Metals

There are several ways to diversify within precious metals investments and as such, instead of focusing solely on one metal or asset type, investors may want to explore a variety of options that suit their own personal risk appetite or investment goals. This could involve diversifying between metals such as gold, silver, and platinum or choosing different forms of bullion like bars, coins, or even digital assets, like DigiGold. By employing a mix of strategies, investors may create a more flexible portfolio that is better able to respond to market fluctuations and potentially offer greater liquidity when it comes time to sell.

Vary Bullion Investments

One possible approach to diversification is by varying bullion investments. This means investing in different forms, such as gold bars, coins, or products of varying weights and sizes. Coins, for instance, may offer more flexibility and liquidity, as smaller denominations are easier to sell in smaller quantities. Popular choices like Sovereign and Britannia coins are widely recognised and, in the UK, are exempt from Capital Gains Tax, providing potential tax benefits for UK-based investors.

On the other hand, gold bars might offer better value for those looking to invest larger sums, as the price per ounce is often lower due to reduced production costs. Larger bars are often used for long-term wealth storage, though they can pose challenges when liquidating, as it is likely you will need to sell them in full, rather than in smaller portions. By holding a combination of different forms and sizes, investors could aim to benefit from both long-term wealth preservation and the liquidity required to respond when market conditions are favourable.

Investing in Silver, Platinum, and Other Metals

While gold is often the first precious metal that comes to mind for investors, diversifying into silver, platinum, and other metals could provide additional opportunities for those looking to expand their portfolio. Silver, for example, is more affordable by weight than gold, making it accessible to a wider range of investors. It also has extensive industrial applications, particularly in electronics and renewable energy, which can influence demand and impact price movements over time. As such, including silver in your portfolio could provide exposure to both the investment itself and industrial markets.

Platinum, another option, is rarer than gold and silver and has its own unique demand, especially in the automotive industry for catalytic converters. While platinum prices can be more volatile, they may present opportunities for those looking to diversify further. Diversifying across these metals could provide a way to spread risk, though it’s important to understand that each metal has its own market behaviour and demand drivers. Considering these factors could help create a more balanced approach within your precious metal investment portfolio.

Physical and Digital for Diversified Investment

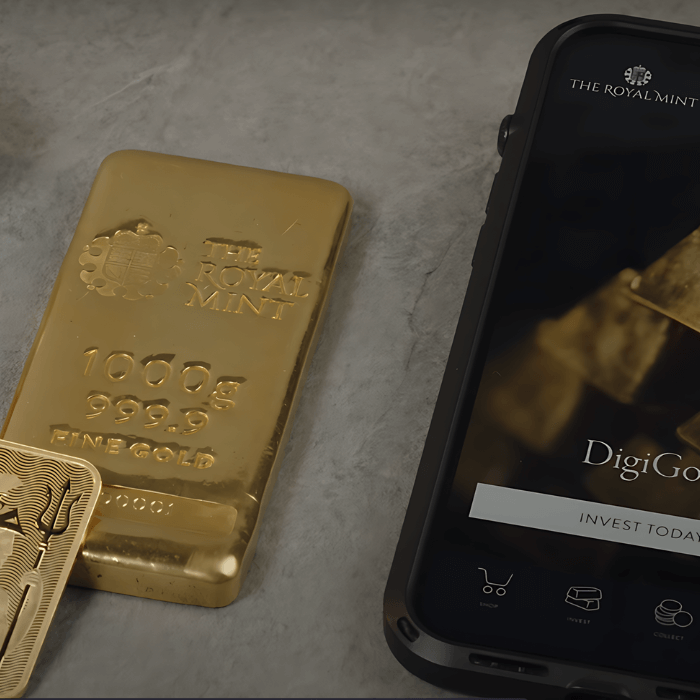

When diversifying your precious metals portfolio, it may be worth considering a combination of both physical and digital gold. Physical gold, such as bars and coins, offers tangible security and the reassurance of owning a physical asset. It can also be a long-term store of value, offering a sense of ownership that digital options may not provide. However, it requires secure storage, either at home or through professional services, and there are potential additional costs for insurance and storage.

Digital gold, on the other hand, provides convenience and ease of trading. Products like The Royal Mint’s DigiGold allow investors to buy and sell fractions of gold quickly without the logistics of physical ownership. Digital investments can offer greater liquidity, making it easier to respond to market fluctuations, but they come with counterparty risk, as you are reliant on the security and reputation of the digital platform.

By holding both physical and digital gold, investors may balance the tangible security of physical assets with the flexibility of digital options, though it's important to assess your personal investment goals and risk tolerance when considering these options.

Invest in Gold-Backed Funds

Gold-backed funds, such as Exchange-Traded Funds (ETFs) or ETCs offer a way to gain exposure to gold prices without the need to physically possess the metal. These funds track the price of gold and allow investors to trade shares on stock exchanges, offering a simple and more liquid way to invest in gold. One of the possible advantages of gold-backed ETFs is that they provide access to the gold market without the logistical challenges of storing or insuring physical gold.

ETFs are typically reasonably accessible and can be traded quickly, making them a flexible option for those looking to respond to market movements. Although this is the case, while you don't own the physical metal itself, ETFs can mirror the performance of gold, allowing investors to benefit (or lose) from price changes. However, it’s important to consider management fees and potential counterparty risk, as you rely on the fund provider to manage the assets.

Short and Long-Term Investments

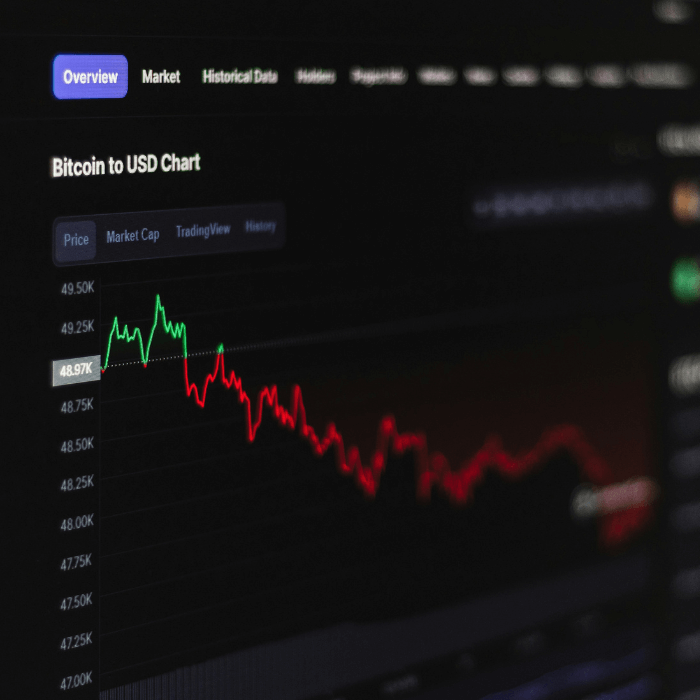

When investing in precious metals, it may be beneficial to consider both short-term and long-term strategies. Short-term investments in precious metals, such as buying during market dips or selling during peaks, can allow investors to potentially capitalise on short-term price movements. This approach requires careful market monitoring and carries a higher level of risk, but it can be useful for those looking to target quicker profits based on market trends.

On the other hand, long-term investments in precious metals, especially in gold, are often viewed as a store of wealth. Gold has historically maintained its value over time, making it a popular choice for those seeking to preserve wealth and attempt to hedge against inflation. Balancing both short-term and long-term strategies may provide flexibility and the opportunity to tailor your investments based on your financial goals and personal risk tolerance.

A Gold Retirement Plan

Incorporating gold into a retirement plan can be an effective way to diversify long-term savings and hedge against economic uncertainty. One method for including gold in your retirement planning is through a Self-Invested Personal Pension (SIPP), such as The Royal Mint’s Gold for Pensions Scheme. A SIPP allows investors to hold a variety of assets, including physical gold, within their pension. By incorporating gold into a SIPP, investors may benefit from the stability and long-term value that gold could offer, particularly as a possible hedge against inflation.

Gold’s historical resilience and its potential ability to preserve wealth over time may make it an appealing option for retirement portfolios. By diversifying with gold, you could protect your retirement savings from volatility in other markets, though it’s important to evaluate your individual financial goals and needs before committing to any retirement strategy. As always, it’s advisable to consult a financial professional before making any long-term investment decisions.

Diversified Investments with The Royal Mint

The Royal Mint offers a wide range of precious metal investment options, including gold, silver, platinum, and digital products such as DigiGold. With expert knowledge and trusted services, The Royal Mint has a range of products which you may choose to diversify your portfolio.

Notes

Both gold and treasury bonds are considered by many to be safe-haven investments with different strengths. Gold offers long-term stability but with short-term price fluctuations, while treasury bonds provide fixed returns if held to maturity. For those interested in diversifying with gold, explore The Royal Mint’s range of investment options, including physical gold and digital assets.

The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.